The Staggering Costs of VIP Whale Status in Macau’s Gaming Scene

Financial Requirements and Risks

The pursuit of elite whale status in Macau’s exclusive VIP gaming clubs demands extraordinary financial resources. Players require minimum liquid assets of $100 million merely to enter this rarefied sphere, yet the stark reality shows 85% of high-rollers deplete seven-figure bankrolls within 48 hours.

Predatory Lending and Credit Structure

Junket operators dominate Macau’s VIP financing landscape, imposing severe interest rates ranging from 1.5% to 3% monthly on massive credit lines up to $20 million. Despite substantial personal wealth requirements, 60% of VIP players still depend on these high-interest funding arrangements, creating a dangerous cycle of dependency.

Profit Margins and Documented Losses

The mathematics of VIP gaming reveals razor-thin profit margins of 0.2-0.3%, while historical records show catastrophic single-session losses reaching $250 million. This combination of minimal returns and extreme risk exposure creates an unsustainable equation for most participants in Macau’s high-stakes gaming environment. 멀티게임 카지노 API 구조

High-Stakes Consequences

The exclusive world of Macau VIP gaming clubs conceals severe financial implications beneath its glamorous facade. With documented cases of complete financial devastation, the pursuit of whale status frequently results in irreversible economic damage, affecting even ultra-high-net-worth individuals.

Inside Macau’s VIP Gaming World

Inside Macau’s VIP Gaming Ecosystem

Understanding VIP Gaming Revenue and Operations

Macau’s VIP gaming sector dominates the region’s gambling landscape, generating over 70% of total gaming revenue through sophisticated junket promoter networks.

These specialized operators facilitate high-stakes gambling for elite players from mainland China, extending substantial credit lines between $500,000 to multi-million dollar amounts while managing collection risks.

Profit Margins and Operational Economics

The VIP gaming room business model operates within extremely narrow profit margins of 0.2% to 0.3%, contrasting sharply with the mass-market segment’s 30% margins.

Successful operations require junket promoters to maintain substantial capital reserves – typically 20-30% of rolling chip volume – to offset potential losses.

The industry’s commission structure awards junkets 40-45% of generated gross gaming revenue, creating an environment where only large-scale operators can maintain sustainable operations.

Risk Management and Market Challenges

Default rates present significant challenges within the VIP gaming ecosystem. Historical analysis reveals that 20-30% of VIP gambling debts remain uncollected, resulting in billions in annual write-offs.

This high-risk environment creates a delicate financial balance, where significant losses can impact even well-funded operations. Consequently, the market has experienced substantial consolidation, with numerous junket promoters either merging operations or departing the sector entirely.

The Making of a Whale

The Making of a High-Stakes Casino Player

Understanding Elite Gaming Status

High-net-worth casino players, commonly known as “whales” in the gaming industry, represent the pinnacle of casino clientele.

These elite players consistently wager $1 million or more per casino visit, demonstrating exceptional betting patterns with minimum stakes of $10,000 per hand across extended gaming sessions.

Financial Requirements and Verification

Achieving premier player status requires substantial financial backing.

Credit lines ranging from $5-20 million are established through junket operators, who conduct thorough financial assessments.

This verification process examines:

- Proof of substantial assets

- Established banking relationships

- Verified business holdings

- Betting volume metrics

- Loss and repayment history

Elite Gaming Metrics

The path to premium player status follows strict numerical criteria:

- Average bets maintain $25,000 per hand

- Monthly chip turnover exceeds $50 million

- Liquid assets surpass $100 million

- Risk tolerance of 1-2% net worth per visit

Statistical Reality

The development of elite players follows a precise ratio in the gaming industry.

From every 100 premium players, only 1-2 individuals advance to the highest tier of play. This selective process ensures that only the most qualified and financially capable players achieve and maintain whale status in casino operations.

Junket Operations and Credit Systems

Understanding Junket Operations and Credit Systems in Macau Gaming

VIP Gaming Revenue and Financial Intermediaries

The junket operator network functions as a sophisticated financial intermediary system, facilitating over 70% of Macau’s VIP gaming revenue through specialized credit arrangements.

These operators typically advance players 20-30% of verified net worth, establishing credit lines that frequently extend into tens of millions of dollars.

Operating essentially as unofficial banking entities, junket operators provide crucial financial services that traditional mainland Chinese banks can’t offer.

Credit Terms and Risk Management

VIP gaming credit operates under specific parameters:

- Interest rates ranging from 1.5% to 3% monthly

- Annual rates reaching 18% to 36%

- Credit assessments based on proven wealth metrics

- Debt collection responsibilities managed by operators

Legal Framework and Debt Recovery

The junket credit system operates within complex jurisdictional boundaries:

- Gambling debts remain unenforceable in mainland China

- Operators maintain extensive asset networks across multiple jurisdictions

- Strategic positioning of collateral holdings in Macau and international locations

- Alternative collection methods developed to ensure debt recovery

High-Stakes Operations and Financial Impact

VIP gaming losses can reach extraordinary levels:

- Single-session losses exceeding $100 million documented

- Comprehensive debt collection networks established

- Multiple layers of financial security measures implemented

- Strategic risk management protocols maintained

Understanding these fundamental operational aspects proves essential for participants in the high-stakes gaming sector.

Devastating Losses Behind Closed Doors

The Hidden Crisis of VIP Gaming Losses in Macau

Unprecedented Financial Devastation in Private Gaming Rooms

Inside Macau’s exclusive VIP gaming rooms, players regularly experience catastrophic losses exceeding $5 million per hand.

High-stakes gamblers have documented losses surpassing $250 million in single sessions, with many depleting substantial credit lines within 30 minutes through ultra-high-stakes baccarat wagers ranging from $500,000 to $1 million per hand.

Statistical Analysis of VIP Gaming Patterns

Critical loss statistics reveal that 85% of VIP players exhaust their entire gaming bankroll within a 48-hour period.

More alarmingly, 60% operate on junket-funded credit with monthly interest rates averaging 3%. This dangerous combination forces many players into leveraging business assets and family properties to cover mounting casino debts.

Psychological Impact and Inadequate Safeguards

Research indicates that 40% of high-stakes players demonstrate problem gambling behaviors, yet Macau’s VIP facilities maintain insufficient intervention protocols.

The lethal combination of readily available credit, private gaming environments, and minimal regulatory oversight creates conditions for catastrophic financial collapse. These factors regularly lead to the decimation of personal fortunes, business empires, and family legacies within mere hours of play.

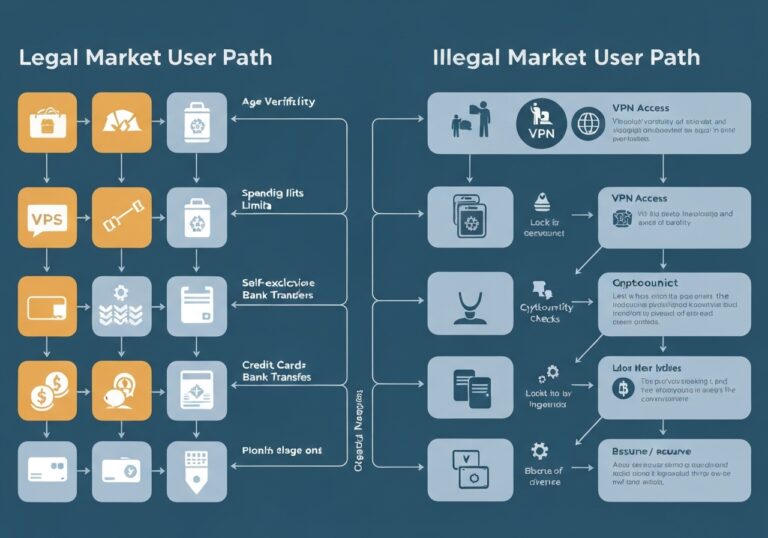

Criminal Enterprises and Money Laundering

Understanding Money Laundering Through Macau’s VIP Gaming Operations

The Scale of Casino-Based Money Laundering

VIP gaming rooms in Macau serve as sophisticated money laundering operations, processing an estimated $200 billion in illicit funds annually.

These exclusive venues provide criminal enterprises with complex financial mechanisms to obscure illegally obtained money through gambling transactions.

Operational Methods and Systems

Junket promoters facilitate intricate money movement schemes through VIP rooms, enabling criminal organizations to convert illegal proceeds into legitimate-appearing funds. The process involves:

- Depositing illicit cash with junket operators

- Converting deposits into gaming chips

- Minimal gambling activity

- Cashing out chips as “legitimate” winnings

Impact and Regulatory Challenges

The financial scale is staggering, with individual VIP gaming operations capable of processing $3 million per hour during peak periods.

Regulatory oversight remains insufficient, with only 1% of suspicious transactions identified by authorities. Key factors enabling this system include:

- Private, non-transparent operations

- Limited regulatory supervision

- Sophisticated transaction networks

- Continuous evolution of evasion techniques

Primary Criminal Activities Facilitated

Money laundering operations typically process proceeds from:

- Drug trafficking networks

- Human smuggling operations

- International corruption

- Organized crime syndicates

Despite periodic enforcement efforts, these sophisticated financial schemes continue to adapt and evolve, maintaining Macau’s position as a crucial hub for international money laundering operations.

Breaking Free From Whale Status

Breaking Free From Whale Status: A Strategic Exit Guide

Understanding VIP Gambling Patterns and Exit Solutions

High-stakes gamblers seeking freedom from Macau’s VIP ecosystem require carefully planned exit strategies.

Three critical steps define successful departures:

- Credit line reduction

- Junket operator boundary setting

- Alternative wealth management implementation

Managing Junket Relationships

VIP gaming operators employ sophisticated retention tactics, typically increasing incentives by 30-40% when premium players attempt to reduce activity.

A strategic 6-12 month drawdown period proves essential for:

- Minimizing operator pressure

- Systematically closing credit lines

- Maintaining financial stability

Asset Protection and Legal Considerations

Wealth preservation demands precise execution through:

- Asset relocation beyond Macau jurisdictions How Philippine Call Centers Power Global Online Gambling Support

- Collaboration with specialized financial advisors

- Regular credit report monitoring

Critical Statistics

- 68% of former whales face aggressive collection attempts

- 23% encounter civil claims from junket operators

Risk Mitigation Strategies

Securing legal counsel with expertise in Asian gaming jurisdictions provides essential protection.

High-net-worth restructuring specialists can facilitate:

- Credit line termination

- Asset protection planning

- Jurisdictional risk management

- Collection defense strategies