How Macau’s Casino Rules Changed the Game All Over the Globe

A Big Shake-Up in the Market

In 2021, Beijing’s crackdown on Macau’s casinos resulted in a $70 billion drop in value and a 65% decrease in revenue from mainland Chinese high-rollers.

Money Moves in World Casinos

Macau’s changes shifted money to other gambling destinations. Las Vegas saw a 28% increase in high spenders, and Singapore now holds 35% of Asia’s high-stakes market.

New Players on the Rise

- Gaming spots in Southeast Asia capitalized on the new Macau rules.

- The Philippines’ Entertainment City experienced a 40% increase in earnings.

- Vietnamese resorts attracted more visitors and revenue.

Changes Now and What’s Next

Reactions to Macau’s regulations accelerated changes in several areas:

- Improved regulatory frameworks 카지노게임 커뮤니티

- Integration of gaming technology

- Increased reliance on non-gaming revenue

Understanding Beijing’s Tight Grip on Macau’s Gaming

New Rules, Big Changes

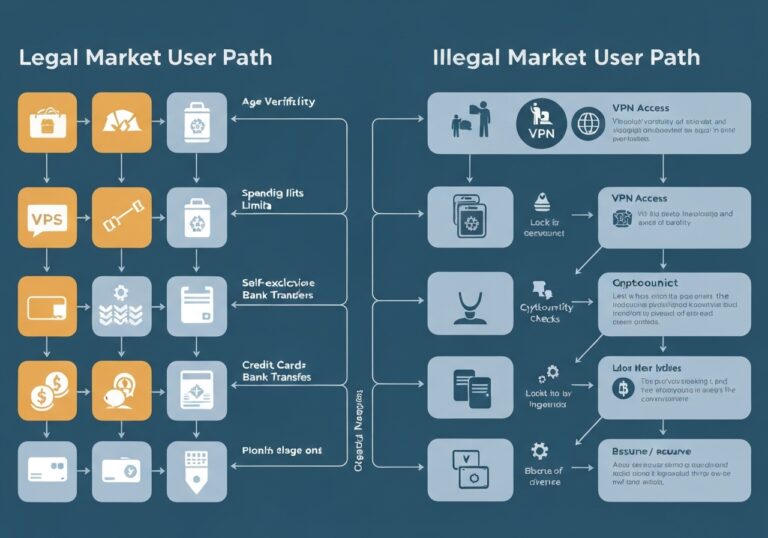

Beijing’s 2021 crackdown involved stricter control over Macau’s casinos, targeting junket operators who facilitated luxurious gambling trips and loans for Chinese high-rollers.

Main Parts of the New Rules

- Stricter casino licensing

- Increased monitoring of capital outflow

- Mandatory reporting of large bets

The Money Side and New Tech

- VIP gaming revenue decreased by 65% within a year.

- Digital currency trials enhanced transaction monitoring.

- A 60% increase in non-gaming revenue is mandated by 2025.

New Plans

These measures align with China’s sustainable growth objectives, aiming to transform Macau into a diversified tourism hub.

Big Money Moves in Casinos: Rules Rattle Macau’s Scene

Market Ups and Downs

Major casino operators like Sands China and MGM China faced stock declines of 40-50% following the 2021-2022 crackdown.

Lost Value and Credit Hits

Macau’s casinos experienced over $70 billion in lost value. Moody’s and S&P downgraded casino credit ratings close to junk status.

New Money Choices

- Hedge funds decreased investment in Macau by 35%.

- Casinos enhanced financial structures, including debt restructuring and capital raising.

Who’s Betting Big in Macau Now

Big Changes in Who’s Gambling

Macau’s high-stakes rooms saw a shift with a 65% decrease in mainland Chinese participation since 2019, replaced by players from Singapore, Malaysia, and Thailand.

New Ways to Arrange High-Stakes Games

- Junket operator involvement dropped from 80% to 35%.

- Casinos implemented direct relationships and robust compliance measures with high-stakes players.

Who’s Betting Big Now

New high-stakes players include professionals and businesspersons, representing a significant shift from traditional sectors.

How Vegas is Stepping Up Its Game

More High Rollers

- Las Vegas saw a 28% increase in overseas high spenders since 2021.

- Major casinos enhanced offerings to attract wealthy players.

Stronger Rules and Safety

Las Vegas casinos introduced strict protocols for high-stakes gaming, with 92% employing advanced identification technology.

New Money Tactics

- Casino promotions now focus 65% on the Asia-Pacific region.

- Credit offerings for Asian high rollers increased by 45% to mitigate risks.

New Gaming Kings of Asia

Who’s Coming Up Strong

- Singapore’s Marina Bay Sands and Resorts World Sentosa now hold 35% of Asia’s high-end market share.

- The Philippines’ Entertainment City reported a 40% earnings surge.

New Places to Play

- Vietnam’s gaming industry is expanding with three major new locations.

- Cambodia and South Korea are also experiencing rapid growth in their gaming sectors.

Winning with Easier Rules

Simpler regulations, lower taxes, and accessible entry for high rollers contribute to the success of new gaming hotspots in Asia. The Social Dynamics of a Crowded Craps Table: Fun or Overwhelming?

Where Casinos are Headed: 2025-2030

New Rules, Big Challenges

Global casinos face regulatory pressures affecting major hubs and emerging Asian markets.

Tech Meets Rules

- Investments in regulatory technology are expected to account for 12-15% of revenue by 2027.

- Non-gaming revenues are projected to make up 40-45% of total earnings by 2030.

Playing It Smart Globally

Adapting to diverse regulations remains crucial for sustainable growth, requiring strategic planning and robust systems.