The Psychology of The IKEA Effect in Sports Betting Systems

Understanding the IKEA Effect's Impact on Betting Behavior

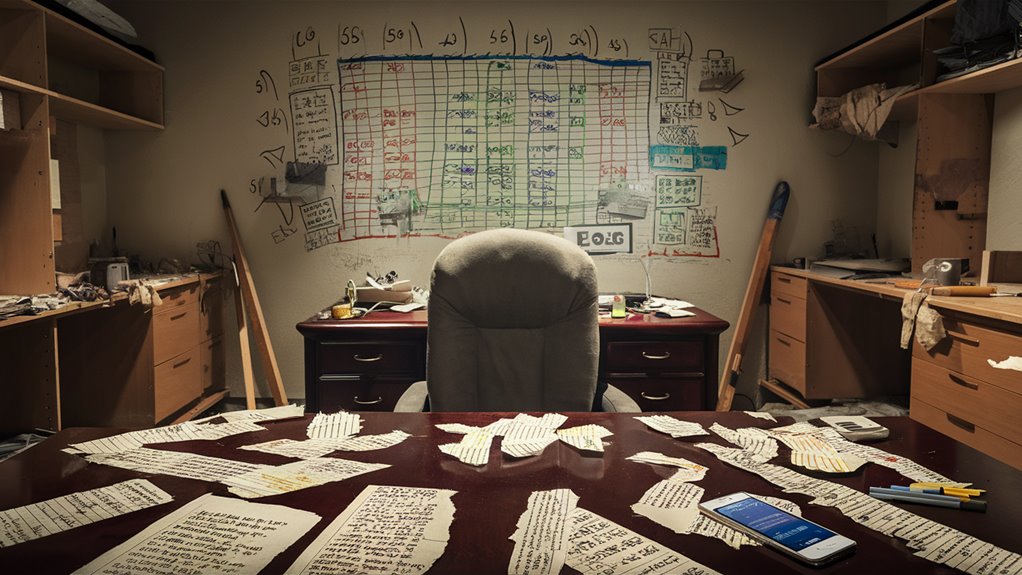

The IKEA Effect creates a powerful psychological trap for sports bettors who develop their own systems. When individuals invest significant time and effort into creating complex betting algorithms, they form deep emotional attachments that override objective performance data.

Psychological Barriers to System Evaluation

Pride of Authorship

Personal investment and sunk time costs make it extremely difficult to abandon losing strategies, even as losses accumulate. The emotional connection to self-developed systems often outweighs rational decision-making.

Cognitive Distortions

Selective memory and confirmation bias cloud judgment in system evaluation:

- Dismissal of negative results

- Overemphasis on occasional wins

- Rationalization of consistent losses

- Resistance to system modification

Professional Exploitation of Behavioral Biases

Professional oddsmakers understand and exploit these psychological tendencies. The attachment to losing systems becomes a significant advantage for bookmakers, as bettors continue implementing ineffective strategies despite mounting evidence of failure.

Breaking Free from the IKEA Effect

Empirical Evaluation

Implementing strict performance metrics and maintaining detailed records helps overcome emotional attachment to failing systems.

Emotional Detachment

Developing objective analysis methods and practicing emotional discipline are crucial for making rational betting decisions.

Understanding these psychological dynamics represents the first step toward developing more effective betting strategies and avoiding the pitfalls of the IKEA Effect.

Understanding The Ikea Effect

Understanding The IKEA Effect: A Cognitive Bias in Decision Making

The Psychology Behind the IKEA Effect

The IKEA Effect represents a powerful cognitive bias where people assign disproportionately high value to products they partially created or assembled themselves.

This psychological phenomenon extends far beyond furniture assembly, influencing decisions across multiple domains including investing, business strategy, and personal projects.

Impact on Decision-Making Processes

When individuals develop their own systems or solutions, they encounter a significant psychological attachment that can cloud objective judgment.

This attachment becomes particularly evident in areas requiring analytical decision-making, such as investment strategies or business planning. The emotional connection to self-created work often leads to overlooking critical flaws or limitations.

Core Mechanisms of the IKEA Effect

Pride of Authorship

The sense of ownership and accomplishment derived from creating something drives individuals to defend their work, regardless of its actual effectiveness or quality.

Time Investment Justification

People tend to rationalize the time and effort invested in their creations, leading to continued commitment despite evidence of poor performance.

Illusion of Control

Creating something ourselves gives us a false sense of mastery and control, potentially leading to overconfidence in our solutions.

Overcoming the IKEA Effect

To combat this cognitive bias, focus on:

- Maintaining objective evaluation metrics

- Regularly reviewing performance data

- Seeking external feedback

- Establishing clear success criteria

- Implementing systematic review processes

Success requires prioritizing data-driven decision making over emotional attachment and being prepared to abandon ineffective systems when evidence demands it.

Creating Your Own Betting System

Creating Your Own Sports Betting System: A Strategic Guide

Understanding Psychological Biases in System Development

The IKEA Effect significantly impacts sports bettors who develop custom betting systems. This psychological phenomenon causes individuals to place excessive value on systems they create themselves, often overlooking critical flaws in their methodology.

The Three Psychological Phases of System Creation

Phase 1: Development Euphoria

During initial system development, bettors experience intense confirmation bias, believing they've discovered a unique edge in the market. This excitement can cloud objective analysis and lead to premature implementation.

Phase 2: Selective Results Processing

Bettors demonstrate cognitive bias by highlighting successful bets while dismissing losses as anomalies. This selective perception undermines accurate system evaluation and performance tracking.

Phase 3: Commitment Persistence

Loss aversion and emotional attachment make bettors reluctant to abandon failing systems, even when faced with substantial evidence of underperformance.

Essential Safeguards for System Development

Performance Metrics

Establish quantifiable benchmarks before system implementation:

- Win rate expectations

- Return on investment (ROI) targets

- Maximum drawdown limits

- Risk management parameters

Documentation Requirements

Maintain comprehensive betting records including:

- Detailed bet rationale

- Market conditions

- Entry and exit points

- Performance analytics

System Evaluation Protocols

Implement strict failure conditions:

- Define specific loss thresholds

- Set evaluation periods

- Create clear system adjustment triggers

- Establish abandonment criteria

Market Efficiency Considerations

Market adaptation inevitably eliminates profitable betting angles through:

- Increased competition

- Improved bookmaker algorithms

- Shifting odds dynamics

- Enhanced risk management systems

Approach system development with scientific rigor, focusing on data-driven analysis rather than emotional investment.

Pride Meets Cognitive Bias

Pride and Cognitive Bias in Betting Systems

The Dangerous Partnership of Pride and Bias

Cognitive biases and emotional attachments form a hazardous combination when developing betting systems, causing bettors to overestimate their analytical abilities while significantly underestimating market efficiency.

The considerable time and effort invested in creating betting systems often leads to the IKEA effect – a powerful psychological attachment that impairs objective evaluation of system performance.

Understanding Psychological Traps

Confirmation Bias in System Development

The development of complex betting algorithms and pattern analysis creates a natural defensive mechanism in bettors. This manifests through selective data interpretation, where positive results reinforce system confidence while negative outcomes are dismissed.

This confirmation bias becomes particularly evident when bettors attribute wins to system effectiveness while categorizing losses as anomalies.

The Impact of Pride on Decision Making

Professional oddsmakers employ sophisticated tools and extensive expertise to establish market prices. However, personal pride in system development can blind bettors to this reality.

The emotional investment in creating a unique betting strategy often overshadows the fact that perceived edges are typically already factored into betting odds.

Maintaining Objectivity

Success in betting requires recognizing these psychological barriers and implementing strict evaluation protocols. System performance must be measured against concrete metrics rather than emotional satisfaction.

Regular analysis of betting results through objective data helps overcome cognitive biases and ensures more effective decision-making in betting strategies.

The Sunk Cost Trap

Understanding the Sunk Cost Trap in Decision Making

The Psychology Behind Sunk Costs

Sunk cost fallacy affects decision-making across various scenarios, particularly in gambling and investment contexts.

When individuals invest substantial time and resources into a failing strategy, they often continue despite mounting losses, creating a destructive cycle of escalating commitment.

How the Trap Manifests

The trap becomes particularly evident when gamblers continue betting through a failing system, justifying their actions through previous investments. Common rationalizations include:

- "Too much time invested to quit now"

- "Need to recover previous losses"

- "System just needs more time to work"

The Impact of Personal Investment

The sunk cost trap becomes especially potent when combined with personally developed strategies.

The deeper the emotional investment and effort in creating betting systems, the stronger the psychological barrier to abandonment becomes, even when faced with clear evidence of failure.

Making Rational Decisions

Effective decision-making requires evaluating each choice based solely on future probability of success. Key principles include:

- Disregarding past investments

- Focusing on forward-looking metrics

- Assessing each decision independently

- Analyzing current market conditions

Breaking Free from Sunk Costs

To overcome this psychological trap, decision-makers must:

- Evaluate opportunities objectively

- Focus on future potential returns

- Ignore irretrievable past investments

- Base decisions on current market analysis

These strategies help maintain rational judgment and prevent the escalation of commitment that often leads to additional losses.

Emotional Investment Versus Reality

Emotional Investment vs Market Reality in Betting

The Psychology of Betting System Attachment

The stark contrast between emotional attachment and market reality creates one of the most significant psychological barriers in betting decision-making.

When bettors invest substantial time developing a betting system, they become emotionally tethered to its perceived potential rather than its actual performance. This emotional investment often obscures mounting evidence of system failure.

Complex Systems and Cognitive Bias

The complexity and personal investment in custom betting strategies directly correlates with resistance to system abandonment.

The mind creates elaborate justifications through cognitive biases, such as "system optimization needs minor tweaks" or "market validation is pending." This self-deception mechanism proves particularly hazardous, impeding objective performance analysis.

Implementing Empirical Validation

Performance Metrics

To overcome emotional barriers, establishing strict empirical checkpoints becomes essential. Successful betting requires documenting system performance through clear metrics:

- Win rate percentage

- Return on Investment (ROI)

- Maximum drawdown figures

Objective Assessment

When performance numbers deviate from initial projections, implementing a systematic pause and reassessment becomes crucial.

Breaking free from emotional attachment requires treating betting systems as testable hypotheses rather than personal creations requiring defense. This approach ensures data-driven decision-making in betting strategy evaluation.

Breaking Free From Failed Systems

Breaking Free From Failed Betting Systems: A Strategic Reset Guide

Recognizing and Overcoming System Attachment

Psychological attachment to failed betting systems creates significant barriers to improvement.

Three critical steps can help bettors break free and develop more effective strategies:

- Recognizing sunk costs

- Accepting empirical evidence

- Implementing a clean-slate approach

Evidence-Based System Evaluation

Statistical analysis provides undeniable proof of system performance.

Key evaluation methods include:

- Track record documentation

- Performance comparison against market odds

- Data-driven result verification

Maintaining detailed records creates an objective foundation for decision-making while confronting cognitive biases that may cloud judgment.

Strategic Reset Protocol

The 30-day system suspension serves as a critical reset period for developing improved betting approaches.

During this phase:

- Build new strategies based on verified statistical models

- Apply fundamental probability theory

- Eliminate emotional decision-making through objective analysis

This cooling-off period enables bettors to acknowledge system failures as learning opportunities rather than personal shortcomings, paving the way for more sophisticated and profitable betting strategies.

Long-term Success Indicators

- Consistent profitability against market odds

- Systematic risk management

- Evidence-based methodology

- Emotional detachment from outcomes

Psychology Behind Gambling System Attachment

The Psychology of Gambling System Attachment

Understanding the Cognitive Bonds to Betting Systems

Psychological attachment to betting systems persists among gamblers despite substantial evidence disproving their effectiveness.

This powerful bond often stems from the IKEA effect – a cognitive bias where individuals place disproportionate value on systems they personally create, regardless of actual performance.

Deep-Rooted Psychological Mechanisms

The development of personal betting strategies triggers significant mental and emotional investment.

This investment activates powerful psychological defenses, particularly confirmation bias, causing gamblers to:

- Vividly remember successful bets

- Minimize or discount losses

- Attribute failures to external circumstances

- Defend flawed systems despite contrary evidence

The Illusion of Control

Complex betting systems create a compelling false sense of mastery over gambling outcomes.

The intricate nature of these systems reinforces the dangerous belief that players have "cracked the code" of games of chance, despite unchanged mathematical probabilities. This psychological phenomenon combines with the sunk cost fallacy to create a robust cognitive trap.

Breaking the Psychological Cycle

The combination of:

- Emotional investment

- System complexity

- Cognitive biases

- Self-protective mechanisms

Creates a powerful psychological framework that maintains attachment to ineffective betting strategies, making rational evaluation and system abandonment extremely challenging for most gamblers.